Competitive Tax Structure Imperative to Keep PA’s Economy, Workforce Ahead of Curve

As State House Readies Massive New Tax on Shale Gas Job Creators, Leaders Must Consider Host of Unintended Consequences

Canonsburg, Pa. – The responsible development of the Marcellus Shale’s clean-burning, homegrown natural gas reserves represents a historic opportunity to revitalize Pennsylvania’s economy by growing its workforce, all while strengthening our nation’s energy security and improving its environment.

In fact, the Reading Eagle took a deep look at these economic, environmental and national security benefits in a weekend story under the headline “Pennsylvania gas reserve could transform U.S. energy market.” But commonsense laws, policies and regulations that encourage this tightly-regulated, environmentally proven production are key to maximizing these benefits for each and every Pennsylvanian and ensuring this transformational opportunity is fully realized. And as Marcellus Shale production expands across the Commonwealth, so too do these much-needed, job-creating benefits.

But as the General Assembly’s legislative calendar quickly draws to a close before this fall’s elections, the Associated Press reports that “Pennsylvania’s House majority leader said Friday that he plans to hold a vote next week on legislation to impose a tax on Marcellus Shale natural gas extraction,“ noting that “Todd Eachus, D-Luzerne, said he will press for a minimum tax of 39 cents per thousand cubic feet.”

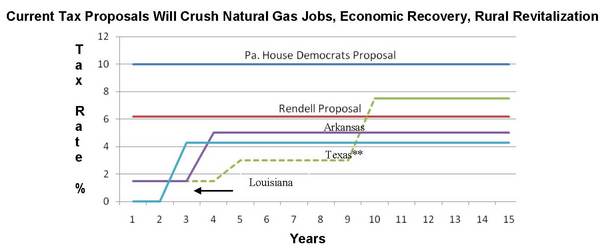

Unfortunately, this proposed new, massive tax – twice as large (and punitive) as West Virginia’s, which is currently the nation’s highest – would drive critical capital investment to other energy-producing states (and countries), dramatically undercutting efforts that are helping to lower energy costs for Pennsylvania consumers and creating jobs at a time when they’re most needed. Here’s a look at the taxes on the books in other shale gas-producing states, which are competing fiercely for the jobs and the critical capital investment needed to produce from the Marcellus:

It’s also important to note that the competing shale gas-producing states, including Texas, Arkansas and Louisiana, all include a capital recovery period in their tax structures, reflecting their commitment to attract investment and job creation – not discourage it – like the model under consideration in the House of Representatives.

In yesterday’s Harrisburg Patriot-News, Kathryn Klaber — president and executive director of the Marcellus Shale Coalition (MSC) — underscores how critical it is that our leaders in Harrisburg “get this right” in a column entitled “Misguided Marcellus Shale tax would cost PA”:

|

We have an opportunity to make Pennsylvania a national leader in natural gas production – a “first” that will afford thousands of Pennsylvanians a good-paying job, spur billions in economic development and provide America with the energy security it so desperately needs.

Our lawmakers should reject any massive, new tax proposal that puts Pennsylvania last.

Copyright: Marcelluscoalition.org