Posts Tagged ‘tax’

Pennsylvania Budget passes without a Marcellus tax or fee

Both the Senate and the House have passed a budget that fails to tax or charge any type of fee on Natural Gas extraction from the Marcellus Shale.

The issue of taxing of Marcellus Shale has been a major topic of discussion, especially in Northeastern Pennsylvania. The impact of the extraction of Natural Gas from the Marcellus Shale has made some people very wealthy and others very upset.

Pennsylvania is the only major natural gas producing state that currently has no tax or extraction fee on natural gas. Governor Tom Corbett campaigned on a platform of no taxes on Marcellus shale and has stuck to that campaign promise in his proposed budget, and the legislature follows suit.

A Quinnipiac poll in June 2011, showed that those polled support, 69 percent to 24 percent, a new tax on companies drilling for natural gas. Even 69 percent of Republicans polled support such a tax.

State Senator John Yudichak (D-14th) says the issue is not dead, and that the legislature will address the issue of Marcellus tax or fees this Fall.

Yudichak, a strong voice for a Marcellus Shale Impact Fee or Severance Tax, also stated that he is disappointed the legislature failed to enact a fair and responsible fee on natural gas drilling, which would have significantly helped address adverse environmental issues associated will drilling.

This is only the third time in more than 40 years that a Pennsylvania State Budget spends less than the previous years. A major factor in the reduction in spending is the loss of federal stimulus money, which allowed Pennsylvania and many other states to save programs and jobs over the past two years. That money is no longer available.

Yudichak, who joined his Democratic colleagues in solidarity in voting against the budget, was not pleased with the budget. Yudichak says the plan falls short of preserving programs and services vital to Pennsylvania’s economic recovery.

On the $27.15 billion spending plan, Yudichak stated that the spending plan cuts too deeply into education and job creation programs, weakens the hospital system and fails to enact a responsible fee on Marcellus Shale drilling.

“For months, I have called for guiding this budget by two principles – job creation and making government more accountable to taxpayers,” Yudichak said. “Unfortunately this budget falls severely short of these principles.”

Yudichak said school districts in the region will face a severe cut of $23,687,669 in this budget. On average that is a 13.3 percent cut from 2010-2011. He added that these districts will now have to cut vital educational programs and layoff teachers, students will be crowded into classrooms and households will inevitably see a spike in property taxes.

Northeastern Pennsylvania school districts will see significant reductions in state revenues. The decrease in funding from 2010 to 2011 is as follows:

· Nanticoke – $1,580,628 less – 13% cut

· Hanover Area- $1,048,569 less – 13% cut

· Hazleton Area – $4,516,132 less – 12% cut

· Pittston Area – $1,260,312 less – 12% cut

· Wilkes-Barre Area – $3,904,811 – less 14% cut

· Wyoming Area – $986,676 less – 12% cut

· Wyoming Valley West – $2,922,455 less – 14% cut

· Pocono Mountain – $4,182,942 less – 17% cut

· Jim Thorpe – $503,404 less – 16% cut

· Lehighton – $1,196,384 less – 13% cut

· Panther Valley – $1,234,349 less – 14% cut

· Weatherly – $351,007 less – 10% cut

Yudichak added that colleges and universities throughout the state will receive significantly less funding in this year’s budget.

“We have some very worthy institutions in our region. Unfortunately, our community colleges, our private colleges and universities, our state system schools and our state- related colleges will see their funding decrease, their tuition increase and the dream of higher education for many students will remain just a dream,” Yudichak said.

He added that cuts to job creation and business support programs in the state Department of Economic Development will harm efforts to rebuild Pennsylvania’s economy.

“It seems awfully misguided to cut proven job creation initiatives during a time of fiscal distress, yet these initiatives have also been zeroed out in this budget plan,” Yudichak said. “True economic growth comes from solid programs that help businesses get off the ground and maintain their workforce.”

Yudichak added that despite modest restorations made to uncompensated care, in the amount of $16.5 million, hospitals are still negatively affected by budget cuts.

“These restorations are a good start, but hospitals really need more funding,” Yudichak said. “And, with adultBasic not being funded in this budget, more and more individuals will turn to hospitals for care.”

“Here and now we have bipartisan support on a fair impact fee that would protect the environment as well as continue to grow the tremendous economic impact of the Marcellus Shale industry, yet it remains unfinished business,” Yudichak said. “The people of Pennsylvania, by an overwhelming majority, have called for a fair and responsible tax or fee on natural gas drilling in the Marcellus Shale region.”

Yudichak finished by saying that while he understands the seriousness of Pennsylvania fragile economy, there were other option available to stem the harsh cuts made in this spending plan.

“I truly understand that with fiscal distress comes the need for a bit of belt tightening, but what I do not understand is why we are selling short the future of Pennsylvania with a budget that weakens job growth and fails to enact a responsible Marcellus Shale severance tax.”

- Get the best political coverage in NEPA at the Examiner. Please click on the “subscribe” icon above to receive email alerts on NEPA politics articles. Your email address will not be shared with third parties.

- Tell your friends, family, and co-workers. We are remaking the way you get your local political news. Follow and hear from your elected officials and favorite candidates without a filter.

Posted At: Examiner.com

Gas Drilling Rig Tax Picking Up Support?

With the increase in gas drilling rig gas production and gas drilling rig accidents and production affecting local communities throughout the Commonwealth reports in Harrisburg show increasing support for some type of “gas tax” in Pennsylvania. Many politicians have voiced opposition to any tax on the gas industry. DLP continues to monitor this issue while representing victims of Pennsylvania truck accidents. gas drilling rig accidents and other serious incidents.

Study assesses state taxes on Marcellus Shale production

University Park, Pa. — The ongoing utilization of Pennsylvania’s Marcellus Shale natural gas deposits has the state weighing the pros and cons of taxing the drilling activity. A study recently released by faculty in Penn State’s College of Agricultural Sciences used state tax information in an effort to begin an objective analysis of the drilling’s impact on local economies and state tax collection.

The research, summarized in a four-page booklet titled “State Tax Implications of Marcellus Shale: What the Pennsylvania Data Say in 2010,” compared counties where there is Marcellus Shale drilling and production activity with non-Marcellus counties. The study was authored by Timothy Kelsey, professor of agricultural economics and Penn State Extension state program leader for economic and community development, and Charles Costanzo, an undergraduate student majoring in community, environment and development.

Data are drawn from the Pennsylvania Department of Environmental Protection’s report, “2010 Wells Drilled by County as of 02/11/2011,” as well as from the Pennsylvania Department of Revenue’s “Personal Income Statistics for 2007 and 2008″ and its “Tax Compendium (2007-08 through 2009-10) with Statistical Supplements.”

Kelsey said while it’s still early in the natural gas drilling process, the analysis indicates that Marcellus Shale development brings some positive economic activity for communities.

The study found that state sales tax collections were up by an average of 11 percent in counties with major Marcellus activity, while collections dropped an average of more than 6 percent in counties without any Marcellus. Sales tax collections are an indicator that retail sales are booming in Marcellus counties.

“Tax revenues are only one side of finances, however, so this analysis only considers half of the issue,” Kelsey said. “The impact of Marcellus drilling on state and local government costs is yet unclear, so it is too early to understand the overall impact of Marcellus on the state government. This state tax analysis does not indicate the impact of Marcellus development on local government and school district tax collections, since royalty and leasing income is exempt from the local earned income tax, and local jurisdictions cannot levy sales taxes.”

Kelsey said researchers wanted to find out if state tax records could yield objective financial data on how local economies are being affected by Marcellus Shale development.

“The state tax information provides a glimpse at how sales activity and personal income are changing,” he said. “The state collects objective tax collection information every year, and that can provide a good snapshot of how residents’ income is changing and the amount of retail activity going on.”

Kelsey explained that the booklet can help the average citizen to understand that Marcellus Shale development is having a discernible economic impact on residents and in communities.

“We’re early enough in the development of the shale that much of what we ‘know’ is based on anecdotes and personal stories,” he said. “This analysis provides some real numbers behind those anecdotes. The data show clearly that there are economic benefits that are accruing because of the gas activity — higher personal tax collections, higher sales tax collections. Realty tax incomes in drilling counties are decreasing, but less than in non-drilling counties.

“The booklet will not tell you how those benefits relate to costs, because we weren’t able to look at that,” he added. “So, it is only a partial picture of what’s going on. You know there are dollars coming in but you don’t know if it’s a net gain or a net loss to the community.”

Kelsey cited increased highway repair and maintenance, greater administrative demands, changing human service needs, and law enforcement and courts among the costs that determine whether the drilling activity is adding to or subtracting from a county’s bottom line.

Kelsey stressed that, because the study focuses only on state tax collection, it doesn’t support assumptions about local tax changes. He points out that local governments don’t have the option of a sales tax, and that the personal income tax increases seen in the study are largely the result of leasing and royalty income, which are both exempted from earned-income tax.

“So we know from this analysis that state revenues are going up, but we don’t know if local tax revenues are increasing or decreasing as a result of the activity,” he said. “That’s a huge caveat.”

Single copies of “State Tax Implications of Marcellus Shale” can be obtained free of charge by Pennsylvania residents through county Penn State Extension offices or by contacting the College of Agricultural Sciences Publications Distribution Center at 814-865-6713 or by email at [email protected]. For cost information on out-of-state or bulk orders, contact the Publications Distribution Center. The publication also is available on the Web athttp://pubs.cas.psu.edu/FreePubs/pdfs/ua468.pdf.

Copyright: PSU.edu

Competitive Tax Structure Imperative to Keep PA’s Economy, Workforce Ahead of Curve

As State House Readies Massive New Tax on Shale Gas Job Creators, Leaders Must Consider Host of Unintended Consequences

Canonsburg, Pa. – The responsible development of the Marcellus Shale’s clean-burning, homegrown natural gas reserves represents a historic opportunity to revitalize Pennsylvania’s economy by growing its workforce, all while strengthening our nation’s energy security and improving its environment.

In fact, the Reading Eagle took a deep look at these economic, environmental and national security benefits in a weekend story under the headline “Pennsylvania gas reserve could transform U.S. energy market.” But commonsense laws, policies and regulations that encourage this tightly-regulated, environmentally proven production are key to maximizing these benefits for each and every Pennsylvanian and ensuring this transformational opportunity is fully realized. And as Marcellus Shale production expands across the Commonwealth, so too do these much-needed, job-creating benefits.

But as the General Assembly’s legislative calendar quickly draws to a close before this fall’s elections, the Associated Press reports that “Pennsylvania’s House majority leader said Friday that he plans to hold a vote next week on legislation to impose a tax on Marcellus Shale natural gas extraction,“ noting that “Todd Eachus, D-Luzerne, said he will press for a minimum tax of 39 cents per thousand cubic feet.”

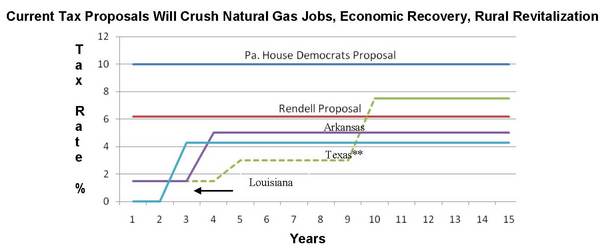

Unfortunately, this proposed new, massive tax – twice as large (and punitive) as West Virginia’s, which is currently the nation’s highest – would drive critical capital investment to other energy-producing states (and countries), dramatically undercutting efforts that are helping to lower energy costs for Pennsylvania consumers and creating jobs at a time when they’re most needed. Here’s a look at the taxes on the books in other shale gas-producing states, which are competing fiercely for the jobs and the critical capital investment needed to produce from the Marcellus:

It’s also important to note that the competing shale gas-producing states, including Texas, Arkansas and Louisiana, all include a capital recovery period in their tax structures, reflecting their commitment to attract investment and job creation – not discourage it – like the model under consideration in the House of Representatives.

In yesterday’s Harrisburg Patriot-News, Kathryn Klaber — president and executive director of the Marcellus Shale Coalition (MSC) — underscores how critical it is that our leaders in Harrisburg “get this right” in a column entitled “Misguided Marcellus Shale tax would cost PA”:

|

We have an opportunity to make Pennsylvania a national leader in natural gas production – a “first” that will afford thousands of Pennsylvanians a good-paying job, spur billions in economic development and provide America with the energy security it so desperately needs.

Our lawmakers should reject any massive, new tax proposal that puts Pennsylvania last.

Copyright: Marcelluscoalition.org

Misguided Marcellus Shale tax would cost Pennsylvania

Kathryn Z. Klaber

The Patriot-News

Sunday, September 26, 2010

- “Our focus must be on getting this opportunity right. To make certain that Pennsylvania’s economy and workforce remain ahead of the curve in the increasingly competitive global economy requires common-sense solutions that encourage capital investment in the commonwealth.”

Pennsylvania’s prosperity has long been a function of its abundant natural resources — and the American experience has long been improved by their use. The commonwealth’s coal helped us win two world wars. Its oil helped power progress and improve our standard of living. And its timber helped form the backbone of our modern society.

Today, we’re leading the way once again with manufacturing of alternative energy technology. And because of the Marcellus Shale and other shale plays nationwide, we’re positioning ourselves to leverage the power of clean energy into thousands of jobs and billions in revenue for Pennsylvanians.

Of course, geologists have known about the Marcellus Shale for a long time — it’s 390 million years old, after all. But thanks to the combination of age-old techniques and new innovations along the way, natural gas reserves previously considered too deep and difficult to access suddenly are not. And considering energy security concerns and the difficult economic times in which we find ourselves today, these discoveries couldn’t have come at a better time.

As of this writing, Pennsylvania’s unemployment rate is still near double digits, and more than 400,000 residents are still out of a job. A recent Patriot-News article reports that “The economic impact of the drilling industry — particularly in rural areas of the state — is indisputable,” noting that the facts are “demonstrable.”

In an otherwise bleak economy, Marcellus Shale development will create nearly 90,000 jobs in Pennsylvania by the end of this year, according to researchers at Penn State, with nearly 211,000 jobs projected through the next decade.

And these aren’t just drilling rig jobs — railroads, engineers, building contractors, supply stores, diners, hotels, steel manufacturers and several other industries and small and medium-size businesses involved in our growing and robust supply chain are all experiencing a significant expansion of growth directly tied to Marcellus production. We call it the “Marcellus Multiplier.”

Our work also is generating billions of dollars in tax revenues and lease payments to Pennsylvania landowners. During the next year, continued Marcellus development will generate more than $1 billion in state and local tax revenues. In 2008 alone, our industry paid more than $1.8 billion in lease and bonus payments to Pennsylvania landowners. But there’s much more to be done, more jobs to be created and more stable supplies of homegrown, clean-burning energy to deliver to Pennsylvania consumers.

Yet as our production expands in Pennsylvania, the competition for the critical capital needed to produce a Marcellus well — each requires about $4 million — grows stronger and fiercer by the day. Other shale gas-producing states — particularly Texas, Oklahoma, Louisiana and Arkansas — want those investments, and those jobs, just as much as we do.

But we’re not just competing with other states for these opportunities. Poland, China, Canada and other foreign nations are working aggressively to secure the capital needed to expand their energy production, too. There’s a reason officials at the Kremlin read news clips from the Marcellus region every morning — and it’s not because they’re looking for coupons.

It’s no secret that our elected officials in Harrisburg are considering a new tax on shale gas production. Unfortunately, some don’t seem to understand that global competition for capital will react to the magnitude of the tax, evidenced by their consideration of a tax that would be the nation’s highest and least competitive.

In fact, it would be higher than West Virginia’s, which stands as one of the least competitive in the nation. And, as of last month, there were 16 horizontal rigs operating in West Virginia’s Marcellus and more than 60 here in Pennsylvania. That’s not a coincidence.

These far-reaching decisions — which will impact the commonwealth’s economy and ability to compete for decades to come — should not be made in isolation to fill a hole in the state budget; that’s the wrong approach and one that will carry several negative unintended economic consequences.

Our focus must be on getting this opportunity right. To make certain that Pennsylvania’s economy and workforce remain ahead of the curve in the increasingly competitive global economy requires common-sense solutions that encourage capital investment in the commonwealth.

Pennsylvania needs strong regulatory and competitive tax frameworks that encourage capital investment and job creation — not a massive, misguided and unprecedented tax that would drive critical capital and jobs to other energy-producing states and countries. This would dramatically undercut efforts that are helping to lower energy costs for Pennsylvania consumers, increase energy security for Americans and bring cleaner fuels to our environment.

As an industry, we are committed — each and every day — to ensuring that this historic opportunity is realized in ways that benefit each and every Pennsylvanian. Our hope, and expectation, is that our government also will work to ensure that this opportunity is realized for decades to come.

KATHRYN KLABER is the president and executive director of the Canonsburg-basedMarcellus Shale Coalition.

Copyright: Marcelluscoalition.org

Gas leases have fiscal implications

Property owners hear about some of the financial complications involved with gas drilling agreements.

Although planning for what to do with gas-lease profits is a problem most people wouldn’t mind having, landowners likely aren’t eager to add paperwork to the already document-laden gas-leasing process.

Experts, however, say protecting the wealth is the same as accumulating it in the first place.

“I’ve seen some horror stories, and if it means going to an attorney and paying a few dollars, it’s worth it,” said Ronald Honeywell, a trust officer with Luzerne Bank who spoke at a seminar on the financial implications of gas leases on Monday evening at Lake-Lehman Junior-Senior High School.

Past seminars on leasing have packed the school’s auditorium, but Monday’s seminar on taxes and investing attracted perhaps 50 people. Presenters admitted that financial topics aren’t often looked forward to but are important nonetheless.

Of particular interest were leasing’s tax implications, such as drilling’s effect on county Clean and Green tax abatement programs. Michelle O’Brien, an attorney with Rosenn, Jenkins & Greenwald in Wilkes-Barre, said drilling would roll back seven years of abatements.

“It’s only fair that the oil company pays that price because they’re the ones kicking you out of Clean and Green,” she said.

However, she pointed out that the company’s payment would likely be a reimbursement, meaning the landowner should be prepared to pay the penalty.

“It sounds like a simple concept, but the money could be a lot of money,” she said, perhaps up to $100,000.

O’Brien also pointed out leases allow landowners to retain control over the location of pipelines and other infrastructure because the property’s marketability could drop depending on where such things are placed.

Even with legal exemption clauses, landowners should retain liability insurance, she said, to cover situations not directly caused by the drilling processes, such as all-terrain vehicles crashes or youths getting hurt on the equipment.

Robert Lawrence, a certified public accountant, explained that the royalties and sign-on bonuses are passive income, similar to rental income, which means they can push landowners into higher tax brackets and impact Social Security or Medicare payments. He suggested that people receiving royalties discuss paying installments on the estimated taxes.

Passing the wealth along creates its own pitfalls, noted Lee Piatt, also with Rosenn, Jenkins & Greenwald. Financial planning and distribution of the proceeds through family corporations or other outlets can avoid some of that, he said.

While it can cause headaches, the increased tax burden can also make some investments more enticing, said Arthur Daube, an investment adviser with Park Avenue Securities. Though their return is low, municipal bonds are tax-free by law, he said, so they can act as havens for profits.

O’Brien also pointed out leases allow landowners to retain control over the location of pipelines and other infrastructure.

Copyright: Times Leader